The CIPD’s Labour Market Outlook is a forward-looking indicator of the UK labour market. It is a quarterly survey of 2,000 employers, providing analysis on employers’ recruitment, redundancy and pay intentions combined with unique insights on labour market topics.

Summer 2023 is characterized by a complex interplay of economic factors, including rising interest rates, inflation, wage growth, and challenges in the labour market. These trends are impacting various aspects of individuals' financial situations, from homeowners dealing with mortgage payments to renters facing higher rents and consumers grappling with increased food prices. Employers are also adapting to the evolving labour landscape, employing a range of strategies to address staffing challenges and wage pressures.

Key findings:

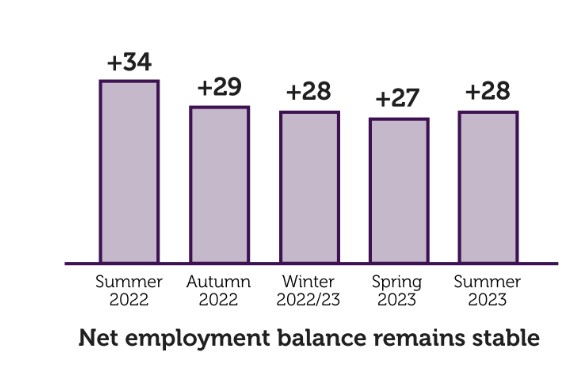

1) Net employment balance remains stable

The net employment balance – which measures the difference between employers expecting to increase staff levels in the next three months and those expecting to decrease staff levels – remains stable at +28. Net employment intentions remain steady in the private sector at +32. However, they have fallen in the public sector in the most recent quarter, from +16 to +11, and have risen in the voluntary sector (from +22 to +34).

2) Redundancy intentions rising in the public sector

Two in five of employers (42%) have hard-to-fill vacancies. These are most prevalent among employers in education (60%) and healthcare (55%). Both industries anticipate significant problems filling their hard-to-fill vacancies in the next six months (42% and 44%).

3) Employers with low-wage staff hit hard by NMW increase

One in five employers (18%) believe increases in the National Minimum Wage (NMW)/National Living Wage (NLW) have impacted their wage bill to a large extent. This impact is particularly pertinent in the hospitality sector, where 43% of employers are feeling the pinch, possibly due to the number of lower-paid workers they employ.

4) Expected pay rises in public sector hit new peak

The median expected basic pay increase remains at 5% for the third consecutive quarter. The figure for the public sector has risen from 3.3% last quarter, to 4% this quarter – the highest in the LMO time series (since 2012).

5) Counteroffers more common in past 12 months

Forty per cent of employers have made a counteroffer in the past 12 months. Among them, half (51%) have delivered more counteroffers than before, with 40% offering the same level and 9% offering less than before.

6) Counteroffers often exceed value of existing offer

Among employers giving counteroffers, 40% offer a higher salary, 38% salary match, and 9% offer a salary below the offer.