The latest KPMG and REC, UK Report on Jobs survey, compiled by S&P Global, indicated that recruitment activity continued to be dampened by economic uncertainty in October. Permanent placements fell, albeit to the weakest extent in four months, as employers were hesitant to commit to new permanent hires. Temp billings meanwhile rose slightly as some firms looked for flexibility in workforces, according to recruiters.

The main findings for October are:

- Permanent placements fall at softest pace since June

The latest recruitment survey signalled that a cautious hiring environment persisted across the UK during October. Notably, uncertainty around the economic outlook contributed to the thirteenth successive monthly reduction in permanent staff hires, albeit with the rate of decline easing to the weakest since June. At the same time, there was a back-to-back rise in temp billings as some employers preferred the flexibility of short-term staff in the current climate.

- Sharper rise in overall candidate supply

The availability of candidates improved for the eighth straight month in October, and at a much sharper rate than in September. This was due to an accelerated upturn in permanent candidate numbers, as temp staff supply rose at a slightly softer (but still marked) pace. There were frequent reports that redundancies and subdued hiring activity had contributed to the latest increase in staff availability.

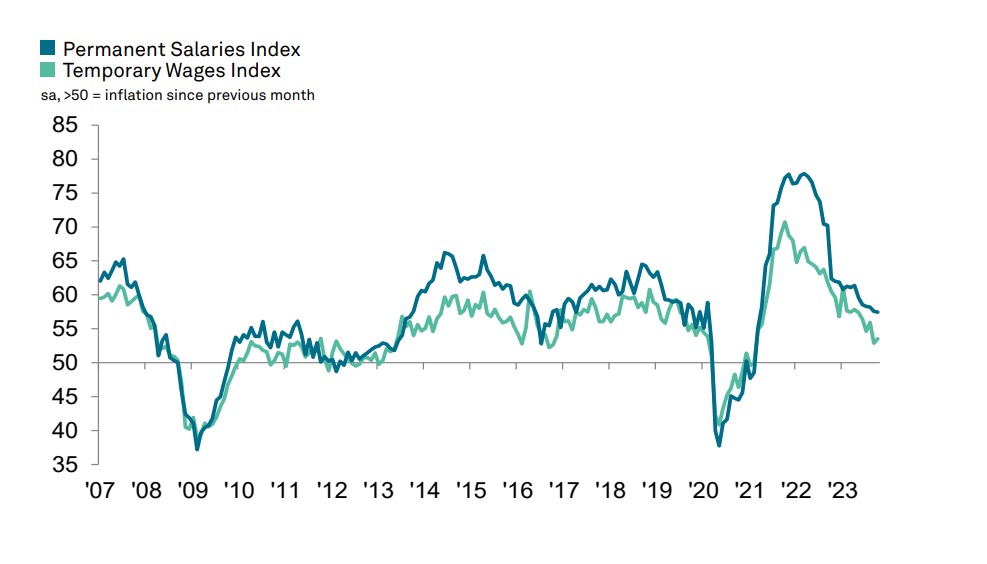

- Starting salary inflation slips to 31-month low

Permanent starters' pay remained on an upward trend in October, though the rate of increase moderated to the weakest in just over two-and-a-half years. Nevertheless, the rate of salary inflation remained sharp and was in line with the series average. Recruiters often mentioned that employers had to up pay offers to secure suitably-skilled staff and to reflect the higher cost of living. Temp wages also increased, though the rate of growth held close to September's recent low.

- Demand for staff stabilises in October

Following a slight reduction in September, overall demand for staff stabilised in October. Underlying data highlighted that permanent vacancies fell only fractionally, while the number of temp positions increased modestly. That said, the latter marked the second-softest improvement in demand for short-term workers since January 2021.

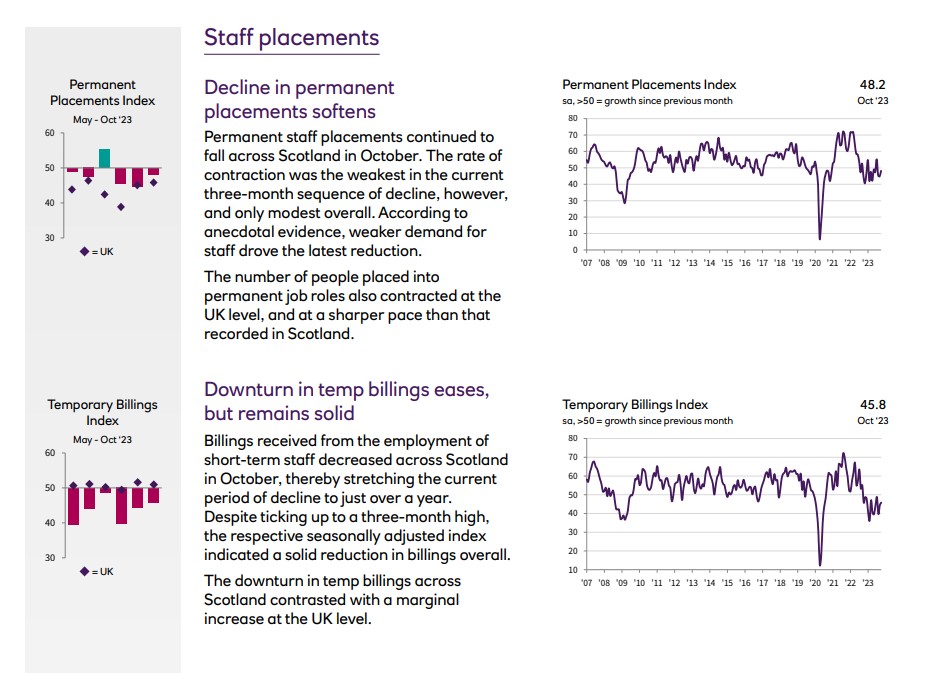

According to the latest Royal Bank of Scotland Report on Jobs survey, recruitment activity continued to weaken across Scotland at the start of the final quarter of 2023. Sustained downturns were recorded for both permanent staff placements and temp billings in October, although rates of decline were the softest seen in three months.

The reduction in hiring activity was accompanied by a steep deterioration in vacancies. Turning to pay, starting salaries and temp wages rose for the thirty-fifth month running in October. According to panellists, clients raised their pay offers due to efforts to secure scarce and suitably-skilled candidates.

Sebastian Burnside, Chief Economist at Royal Bank of Scotland, commented: "The latest data highlighted ongoing weakness across the Scottish jobs market. Hiring activity was cutback, with recruiters noting softer demand for both permanent and temporary staff in October. Moreover, souring demand for labour could lead to further reductions in recruitment in the months ahead. The data therefore suggest that the post-lockdown hiring boom is long over, and that increased uncertainty surrounding the economic climate is weighing on business decisions and candidate movement.”

READ FULL REPORT HERE