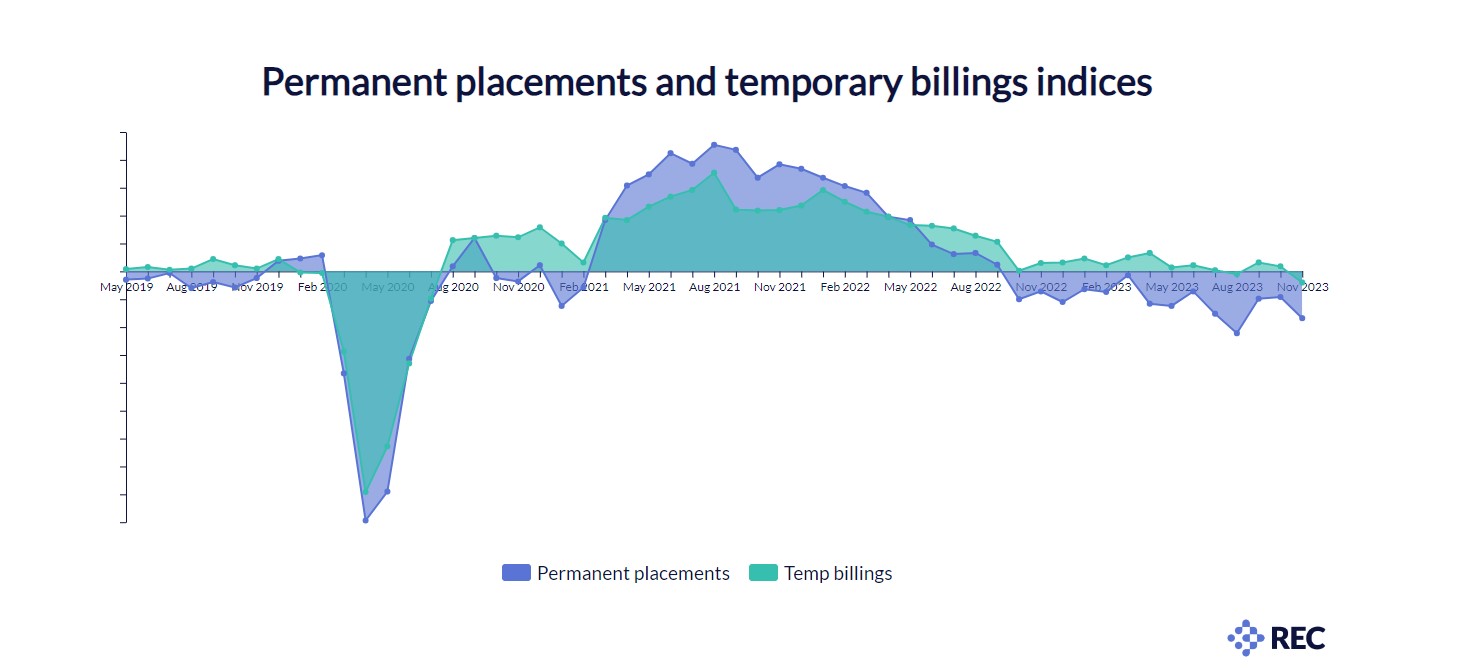

According to the latest KPMG and REC, UK Report on Jobs survey, compiled by S&P Global, permanent staff placements and temp billings decline in November.

The overall availability of candidates meanwhile rose at a rapid pace that was the quickest since December 2020, with recruiters widely linking this to redundancies and workers concerned about current job security. At the same time, pay pressures receded again in November. Notably, rates of starting salary and temp pay inflation slipped to 32- and 33-month lows, respectively.

The slowdown in hiring and reports of redundancies pushed up the availability of workers for the ninth straight month in November. While the upturn in permanent staff supply continued to exceed that seen for temp candidates, both rose at rapid rates that were the sharpest since December 2020.

Recruitment consultancies showed a further easing in the rate of starting salary inflation in the latest survey. Though sharp, the increase in permanent starters' pay was the least pronounced since March 2021 and below the series long-run trend. At the same time, temp wages rose at the slowest rate in 33 months. While competition for suitably skilled workers continued to push up pay overall, budgetary pressures at clients had reportedly weighed on overall growth.

“The UK labour market remains tight as we move towards the end of a difficult year for the UK economy. The balance of supply vs demand is out of sync: we’re seeing even more people looking for work, with candidate supply rising at the fastest pace since the initial pandemic wave three years ago, but the number of available roles falling again in November. Employers are reining in hiring and continuing with redundancies in response to the sustained economic slowdown.” commented Claire Warnes, Partner, Skills and Productivity at KPMG UK.

Regional and Sector Variations

- London recorded by far the steepest reduction in permanent placements of all four monitored English regions. The Midlands was the only area to see an increase, albeit one that was mild overall.

- Divergent trends were seen at the regional level, with temp billings falling in the South of England and London but rising slightly in the Midlands and the North of England.

- Latest data signalled that permanent vacancies fell in both the private and public sectors, with the latter noting the quicker rate of decline. The overall upturn in demand for temporary staff was meanwhile supported by the private sector, as short-term vacancies continued to fall in the public sector.

- Sector data revealed that demand for permanent staff fell in half of the ten monitored categories. Construction saw the steepest rate of decline, followed by Executive/Professional. The Nursing/Medical/Care and Engineering sectors meanwhile saw the strongest upturns in demand.

- Short-term vacancies rose in just over half of the ten monitored employment categories during November. Hotel & Catering saw the quickest rise in demand for temporary staff. Of the four sectors that saw demand weaken, the steepest drop in vacancies was signalled for Retail staff.

Neil Carberry, REC Chief Executive, said: “2023 has been a testing year in our labour market, with permanent hiring dropping and temporary hiring flat or growing only a little. That’s the story again in this month’s data, though the market is quieter overall as firms start to move activity into 2024 rather than pressing ahead now. The averages hide a great deal of variability in regions and sectors though. The Midlands and the North both saw strong performances for temporary and permanent roles, in sharp contrast with London and the South, with permanent hiring in London especially slow. The ongoing stronger performance of the private sector on new vacancies is also a notable positive signal.”

SEE FULL REPORT HERE